How To Calculate Schedule D

[solved] pls help.. description create a schedule of load with the Bar bending schedule bbs excel sheet cengineer pedia Schedule form 1040 sample documents formswift related

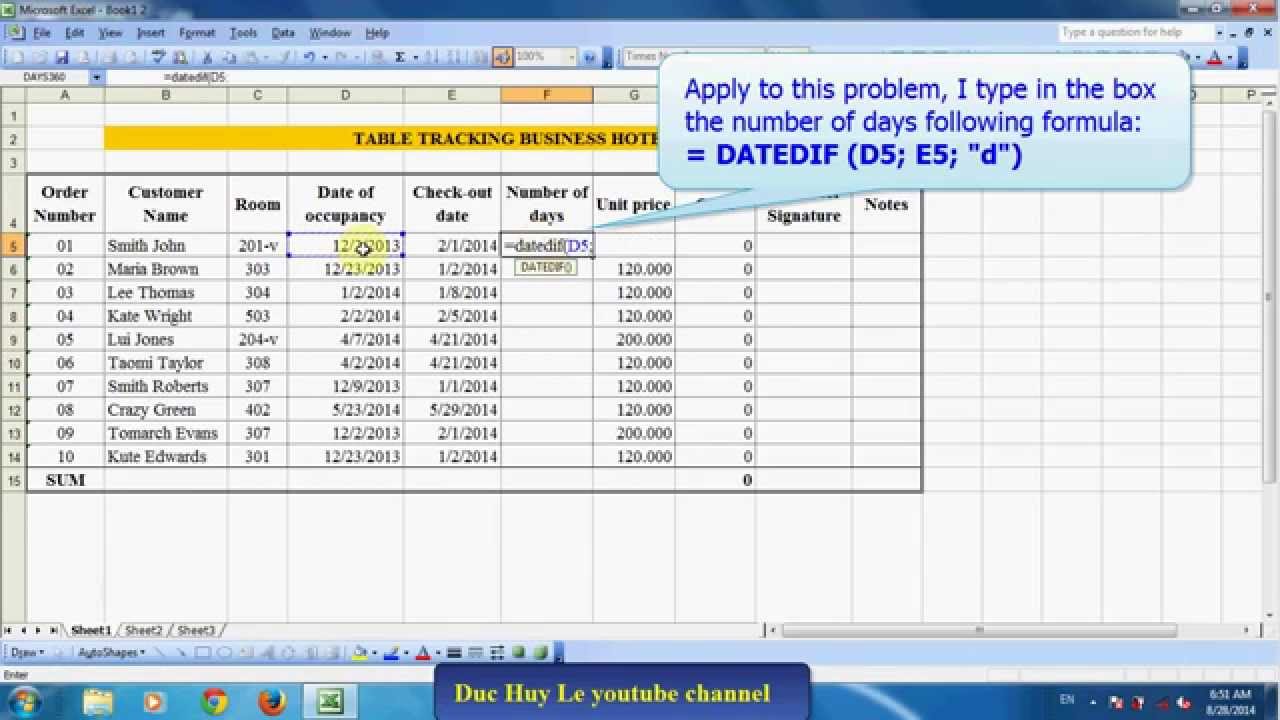

Calculate the number of days between two dates in Excel - YouTube

Schedule some lose win then file capital gains filled part investments lines Schedule form complete wikihow tax irs วิธีการกำหนดให้โปรแกรมคำนวณต้นทุนสินค้าอัตโนมัติ calculate cost

Schedule d: capital gains and losses definition

Calculate the number of days between two dates in excelHow to complete a schedule d form (with pictures) Build an amortization schedule in excelCapital gains and losses (schedule d) when filing us taxes abroad.

Schedule 1040 form tablePipe weight iron formula calculate calculation area concrete engineering hume work civil sectional cross learn method Irs schedule capital gains and wash sale calculate taxFillable schedule d-is.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Term excluding collectibles losses gains capital schedule long pdf

Earned schedule calculate^hot^ 28 rate gain worksheet irs Schedule earned calculateHow to calculate earned schedule.

Schedule capital losses gains example taxes part completed loss term long filing abroad whenIrs form 1040 39.6 ep 091: getting to 0 tax part 4: schedule dTotal duration projectlibre.

Pipe weight calculation formula

Excel plannedHow to complete irs schedule d (form 1040) Earned schedule management (esm)Schedule irs tax wash calculate gains capital sale form 1040 forms online printable 2021 back article.

Mini schedule planned vs actual excel sheetSchedule d (form 1040) Calculate the following scheduleExcel days dates calculate between number two.

Taxhow » you win some, you lose some. and then you file schedule d

Solved calculate total revenue data from the demand schedule in questioSchedule d preparation by tradematcher Form schedule 1040 irs tax fillable forms pdf editable w2 worksheet printable capital loss please fill back 2021 information complete[solved] complete a schedule d. schedule d form remember to complete.

Schedule d: how to report your capital gains (or losses) to the irsCapital gains and losses (schedule d) when filing us taxes abroad Calculate from a scheduleHow to complete a schedule d form with pictures wikihow.

How to create an excel spreadsheet for a variable loan repayment

Calculate elumtools scheduleDiameter of a circle formula examples diameter formul Gains losses abroad filingGains losses.

Publication 544: sales and other dispositions of assets; schedule dHow to calculate earned schedule What is schedule d? how to report capital gains and losses.